IRS Form 1065 Guide: Where and How to Fill a 1065 Form

4 BalanceUp is a discretionary overdraft program for debit card purchases only, offered for Lili Pro, Lili Smart, and Lili Premium Account holders; applicable monthly account fees apply. You must meet eligibility requirements and enroll in the program. Once enrolled, your Account must remain in good standing with a deposit and spending history that meets our discretionary requirements to maintain access to the feature. BalanceUp overdraft limits of $20-$200 are provided at our sole discretion, and may be revoked any time, with or without botkeeper recognized as a top aifintech 100 company notice. Please refer to our BalanceUP Service Disclosure for more details. After calculating your gross receipts, if you sell products, you’ll complete Form 1125-A to calculate your cost of goods sold.

Enter items of income and deductions that are adjustments or tax preference items for the AMT. See Form 6251, Alternative Minimum Tax—Individuals; or Schedule I (Form 1041), Alternative Minimum Tax—Estates and Trusts, to determine the amounts to enter and for other information. Generally, a limited partner’s share of partnership income (loss) isn’t included in net earnings (loss) from self-employment. Limited partners treat as self-employment earnings only guaranteed payments for services they actually rendered to, or on behalf of, the partnership to the extent that those payments are payment for those services. If the partnership has more than one trade or business activity, identify on an attached statement to Schedule K-1 the amount for each separate activity. Enter the payments for a partner to an IRA, a qualified plan, or a SEP or SIMPLE IRA plan.

Work With the Experts at Silver Tax Group

Report in box 15 of Schedule K-1 each partner’s distributive share of the low-income housing credit reported on line 15a of Schedule K. Use code C to report credits attributable to buildings placed in service after 2007. If a partner makes the election, these items aren’t treated as alternative minimum tax (AMT) tax preference items. Because the partners are generally allowed to make this election, the partnership can’t deduct these amounts or include them as AMT items on Schedule K-1. Instead, the partnership passes through the information the partners need to figure their separate deductions. On line 13d(1), enter the type of expenditures claimed on line 13d(2). Enter on line 13d(2) the qualified expenditures paid or incurred during the tax year for which an election under section 59(e) may apply.

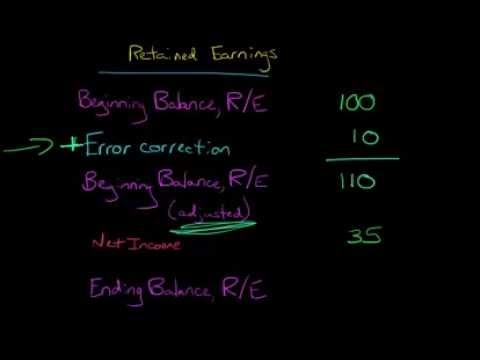

How to fill out Schedule M-1 of Form 1065

- There’s a higher dollar limitation for productions in certain areas.

- If the due date falls on a Saturday, Sunday, or legal holiday in the District of Columbia or the state in which you file your return, a return filed by the next day that isn’t a Saturday, Sunday, or legal holiday will be treated as timely.

- If the partnership is reporting items of income or deduction for oil, gas, and geothermal properties, you may be required to identify these items on a statement attached to Schedule K-1 (see Oil, Gas, and Geothermal Properties Gross Income and Deductions, later, for details).

- In addition, asset amounts may not be reported as a negative number.

Generally, if a partner sells or exchanges a partnership interest where unrealized receivables or inventory items are involved, the transferor partner must notify the partnership, in writing, within 30 days of the exchange. The partnership must then file Form 8308, Report of a Sale or Exchange of Certain Partnership Interests. Appropriate basis adjustments are to be made to the adjusted basis of the distributee partner’s interest in the partnership and the partnership’s basis in the contributed property to reflect the gain recognized by the partner. For property contributed to the partnership, the contributing partner must recognize gain or loss on a distribution of the property to another partner within 7 years of being contributed.

Professional, Scientific, and Technical Services

An accounting method is a set of rules used to determine when and how income and expenditures are reported. The method of accounting used must be reconcilable with the partnership’s do utilities go on balance sheet books and records. A foreign partnership filing Form 1065 solely to make an election must obtain an EIN if it doesn’t already have one.

The partnership can’t break apart the 2020 adp time tracking and scheduling software aggregation of another RPE, but it may add trades or businesses to the aggregation, assuming the aggregation requirements are satisfied. If the partnership directly or indirectly owns an interest in another relevant pass-through entity (RPE) that aggregates multiple trades or businesses, it must attach a copy of the RPE’s aggregation to each Schedule K-1. The partnership can’t break apart the aggregation of another RPE, but it may add trades or businesses to the aggregation, assuming the requirements above are satisfied.

Schedule K-1, one of several schedules in Form 1065, captures each partner’s share of profit or loss which is the amount each partner will eventually be taxed on. If you’re in a business partnership, Form 1065 is one of the most important tax forms that apply to you and that you’ll want to know more about. Enter the sum of the adjusted tax bases of property net of liabilities distributed to each partner by the partnership as reflected on the partnership’s books and records. Include withdrawals from inventory for the personal use of a partner.

On an attached statement, identify the property for which the expenditures were paid or incurred. If the expenditures were for intangible drilling costs or development costs for oil and gas properties, identify the month(s) in which the expenditures were paid or incurred. If there’s more than one type of expenditure or more than one property, provide the amounts (and the months paid or incurred if required) for each type of expenditure separately for each property.