What is Gann Theory

Contents

- Discover How to Use WD Gann Trading Strategies in a Simple to Understand Course

- WD GANN Theory Methods 2023 – Trade Nifty 50 Stock Market

- Trading Strategies using Average Directional Index (ADX)

- Recession In India ? 30 Years Gann Time Cycle, fascinating Facts On Stock Market !

- Some good insights about the ultimate gann course in India

⦿ Course does not guarantee any profits in share market. It moved from 0 degree towards 45 degree i.e. 849 to 834, & bounced really well. Explanation part of the selected concept of Gann which is applied onAXIS BANK Ltd On 28/11. Explanation part of the selected concept of Gann which is applied onAXIS BANK Ltd On 23/1.

Cardinal numbers are the ones in Blue and ordinal numbers are the ones in Yellow. You’ll also notice that the ordinal numbers are square numbers. D. Gann explained that any number that falls on any of these numbers works as strong support or resistance depending on the stock. “WD Gann Trading Theory” course videos are for educational and information purpose only.

Discover How to Use WD Gann Trading Strategies in a Simple to Understand Course

Elearnmarkets is a complete financial market portal where the market experts have taken the onus to spread financial education. ELM constantly experiments with new education methodologies and technologies to make financial education effective, affordable and accessible to all. You can connect with us on Twitter @elearnmarkets. Don’t ignore a Double Top & Triple Top signal on a monthly chart, after a minimum gap of 6 months.

From here it could not complete 45 degree distance downside so did not get trading opportunity of buying it @ 45 degree. AXIS BANK LTD started wd gann theory moving downward from marked 0 degree point. From here it could not completed 45 degree distance & could not get a trading opportunity.

WD GANN Theory Methods 2023 – Trade Nifty 50 Stock Market

In a highly uptrending market weekly low is achieved on Tuesday. The entire week is achieved on Friday, expect higher prices next week. These targets can be calculated on a variety of websites, as well as your stop loss. This means that resistance has been broken and the price will move down.

- As per the standard study & observation have shared more than 50+ examples Of WD Gann Hypothesis which you may find here or on twitter handle.

- Many trading techniques are in use, and this one is highly impressive for stock valuation and in use by current traders.

- These factors are further elevated in terms of short-term, long-term, mid-term etc.

- Cardinal numbers are the ones in Blue and ordinal numbers are the ones in Yellow.

- A trader must always enter a trade with a stop loss.

This theory will help you to analyze the market and predict future stock price movements. It is crucial to always backtest your strategy and put a stop loss in every trade. WD Gann Square, a technical tool developed by WD Gann, a technical expert. This tool is used in the form of spiral a calculator for analysing the stock movements and achieve accurate prices.

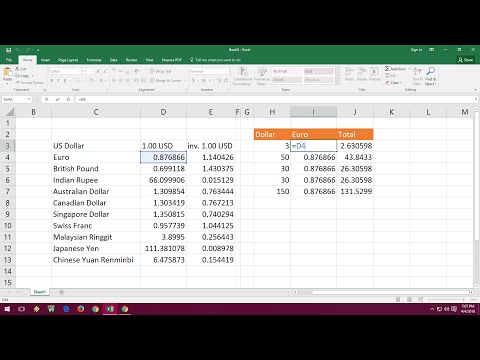

With Gann Calculator conversion of price to degree can be done. With Totalizer of Gann conversion of price to degree can be done. With Calculator of Gann, conversion of price to degree can be done. With Gann Abacus conversion of price to degree can be done.

Trading Strategies using Average Directional Index (ADX)

• It consists of a series of nine diagonal lines called Gann angles. Because of the equidivided lines, it looks like a Chinese hand fan. Say I have identified day high and low of State Bank of India as 2220 and 2176 at a particular time and currently SBI is trading at 2187. If I wish to enter a trade based on this procedure then I will do the following. C. In the price cross over of 30 degree in resistance side we will buy the stock and vice-verse. This Gann indicator has cardinal and ordinal numbers.

D. Gann was of the opinion that there exists a time cycle in nature that applies to the market as well. The discovery of his theory was based on natural geometric shapes, astrology, astronomy, and ancient mathematics. It indicates the past, present, and future characteristics of the stock price.

To understand the Gann theory calculations one needs to study the behavior of the following three things in the market. The whole theory of Gann is on the basis of angles. In this segment of the story, we shall study the Gann angles.

From here it completed 45 degree distance resisted & moved further upside. It tried touching 90 degree but could not even touch 90 degree value i.e. 768. Here Only 1 trading opportunity is identified i.e. @ 45 degree post 12 pm . So, Even if participated @ 45 degree initially i.e. @ 755, finally after 12 pm noticed tradable rejection till 746. ] Values of 0,45 & 90 degree are displayed on price chart with a small excel file, those values can be found by using Gann Abacus. ] Values of 0,45 & 90 degree are displayed on price chart with a small excel file, those values can be found by using Abacus of Gann.

Remember, it is important to enter every trade with a stop loss and backtest your strategy always. He believed that using this theory, anyone can predict future price movements. The technique is relatively easy to understand but difficult to apply. An average trader is not likely to earn similar profits by using this theory without any knowledge. NTA®is a leader in providing stock market education to investors.

& Another trading opportunity was supposed to be of going short @ 45 degree upside i.e. @ 765. Both side trading opportunity was not materialised. Gann time as well as price theory can be used to study patterns as explained. Make sure that you do not violate any of these WD Gann trading rules if you decide to make a trade. These rules are essential and very important to your successful trading.

Recession In India ? 30 Years Gann Time Cycle, fascinating Facts On Stock Market !

With the help of the Gann angle, a trader can set targets and trade accordingly. Gann trading strategy can be used to predict support https://1investing.in/ and resistance levels of an asset with the help of Gann angles. W.D Gann developed a slew of unique methods to analyze price charts.

Most commonly, Gann angles are used to locate support and resistance lines. This trading strategy was developed by Gann based on the assumptions. For Gann Angles rice/run of 1×1 will always equal 45-degree angle. Gann states that price and time are at their best when they rise or fall at a 45 degree angle relative to each other. • Gann Fan is an indicator that is based on the idea that the market is geometric and cyclical in nature.